social security tax limit 2021

The wage base limit is the maximum wage thats subject to the tax for that year. This is the largest increase in a decade and could mean a higher tax bill for some high earners.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

For earnings in 2022 this base is 147000.

. In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000. Web In 2021 the threshold was 18960 a year. For earnings in 2022 this base is 147000.

This amount is also commonly referred to as the taxable maximum. For the 2021 tax year single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Web Listed below are the maximum taxable earnings for Social Security by year from 1937 to the present.

Web If your combined income is more than 34000 you will pay taxes on up to 85 of your Social Security benefits. Refer to Whats New in Publication 15 for the current wage limit for social security wages. How is Social Security taxed 2021.

C Taxable pensions wages interest dividends and other. Up to 85 percent of your benefits if your. Thus an individual with wages equal to or larger than 147000 would contribute.

Higher benefits are possible for those who work or delay benefit receipt after reaching FRA. Web If they are single and that total comes to more than 25000 then part of their Social Security benefits may be taxable. B One-half of amount on line A.

If you have a combined income of more than 44000 you can expect to pay. Will I have to pay back the. Web We call this annual limit the contribution and benefit base.

Most people need 40 credits to qualify for retirement benefits. Up to 50 percent of your benefits if your income is 25000 to 34000 for an individual or 32000 to 44000 for a married couple filing jointly. In addition your future benefit amount will not.

Anything you earn over that annual limit will not be subject to Social Security taxes. Or Publication 51 for agricultural employers. You can earn a maximum of four credits each year.

Web When you work you earn credits toward Social Security benefits. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. Web Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

Social Security Tax Limit Example. What is the 2021 Social Security limit. They dont include supplemental security income payments which arent taxable.

Answer Simple Questions About Your Life And We Do The Rest. Web For 2021 the maximum taxable earnings limit is 142800. Web In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000.

Web The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Web 9 rows This amount is known as the maximum taxable earnings and changes each. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Youll be taxed on. Web Only the social security tax has a wage base limit. 2021 Social Security Taxes.

Benefit formula bend points for workers with first eligibility in 2021. Social Security benefits include monthly retirement survivor and disability benefits. If that total is more than 32000 then part of their Social.

Web Worksheet to Determine if Benefits May Be Taxable. For married couples filing jointly you will pay taxes on up to 50 of your Social Security income if you have a combined income of 32000 to 44000. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level.

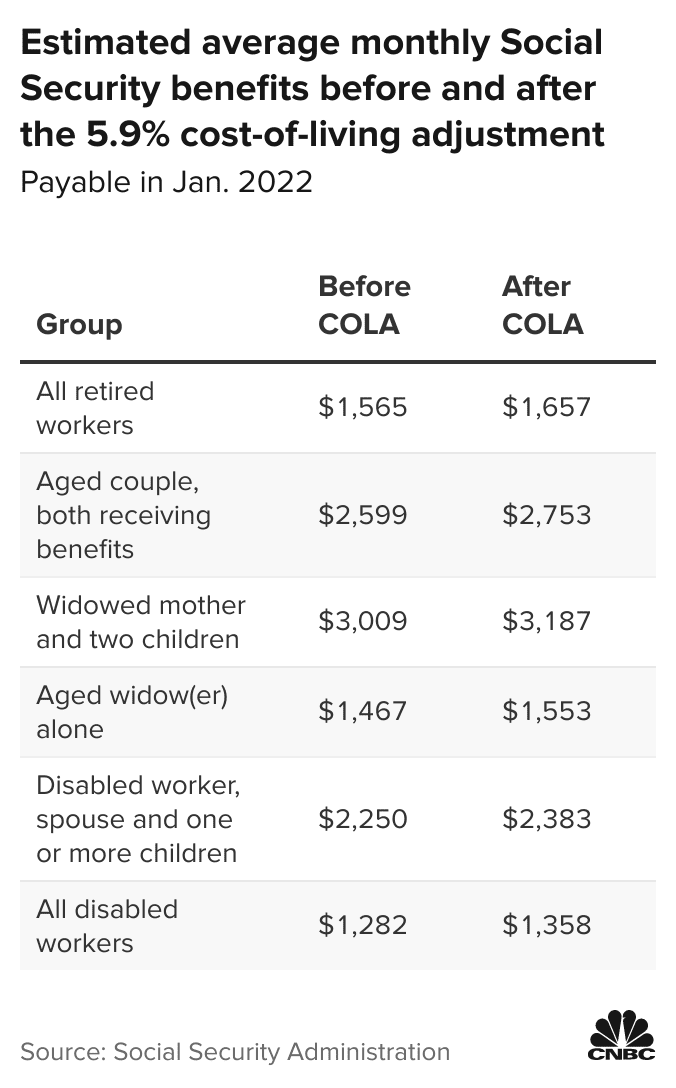

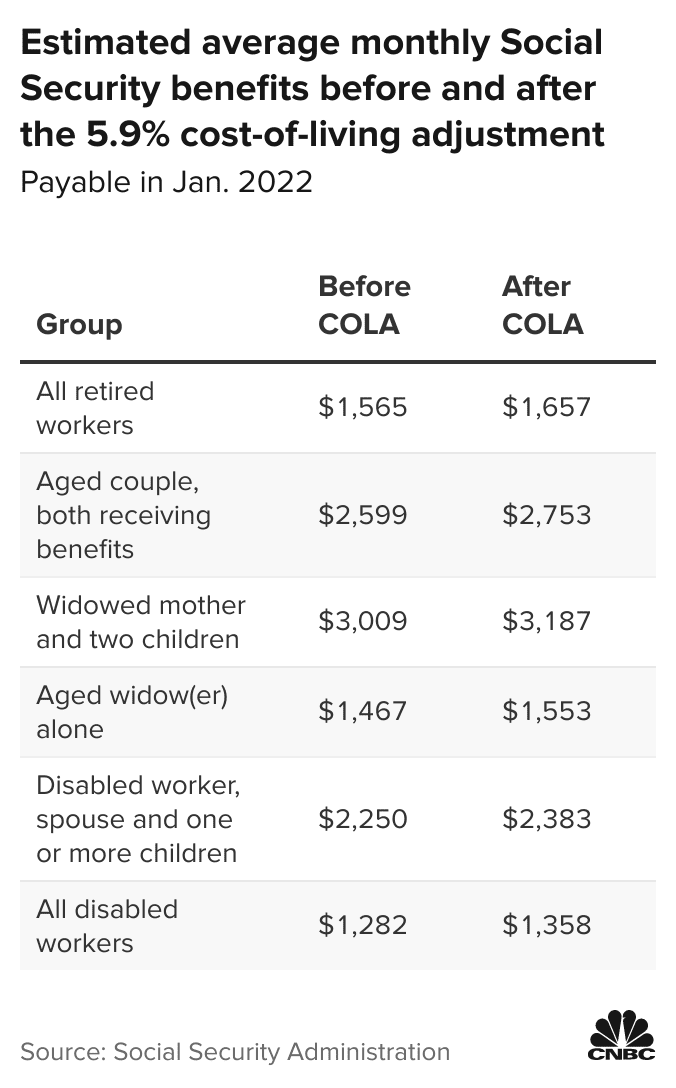

What is the income limit before Social Security is taxed. The maximum amount of Social Security tax an employee will pay. Web Maximum monthly Social Security benefit.

During the year you reach full retirement age the SSA will withhold 1 for every 3 you earn above the limit. If your combined income was. Year Maximum Taxable Earnings 1937-1950 3000 1951-1954 3600 1955-1958 4200 1959-1965 4800 1966-1967 6600 1968-1971 7800 1972 9000 1973 10800 1974 13200 1975 14100 1976 15300 1977 16500 1978 17700 1979 22900.

The current rate for Medicare is 145 for the. A Amount of Social Security or Railroad Retirement Benefits. The portion of benefits.

Web IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Web The tax rate for Social Security tax is 62 Both the employee and employer must pay this. D Tax-exempt interest plus any exclusions from income.

Web What is the Social Security cap for 2021. Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. That limit was 50520 a year in 2021 and will increase to 51960 a year in 2022.

The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each. 3148 for workers retiring at FRA in 2021 NOTE. If they are married filing jointly they should take half of their Social Security plus half of their spouses Social Security and add that to all their combined income.

That threshold will rise to 19560 a year in 2022. The number of credits you need to be eligible for Social Security benefits depends on your age and the type of benefit for which you are applying.

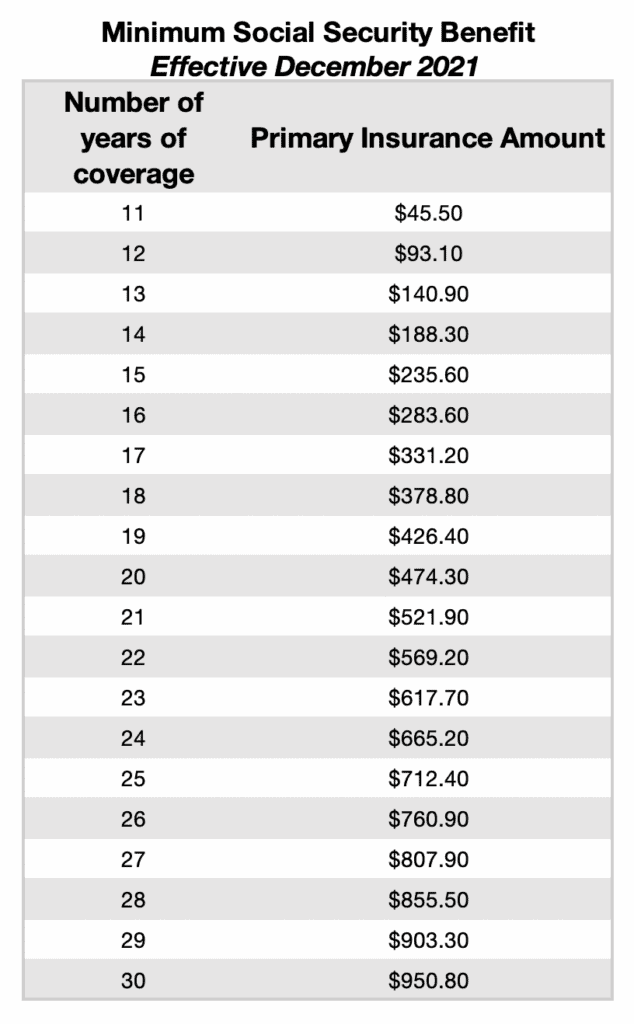

What Is The Minimum Social Security Benefit Social Security Intelligence

At What Age Is Social Security No Longer Taxed In The Us As Usa

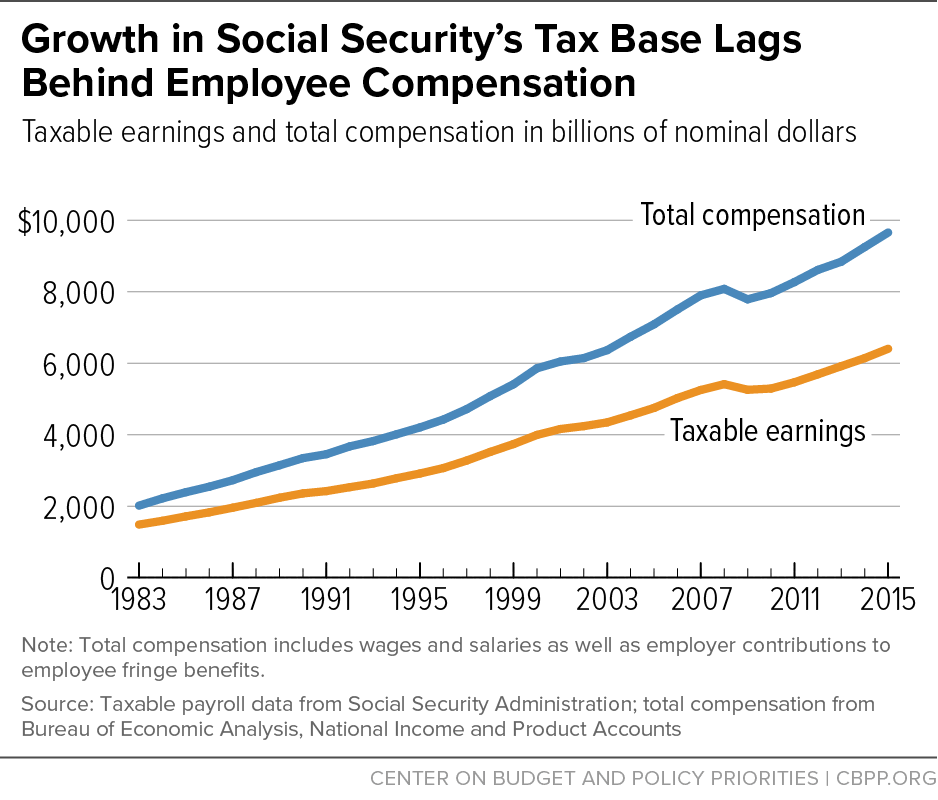

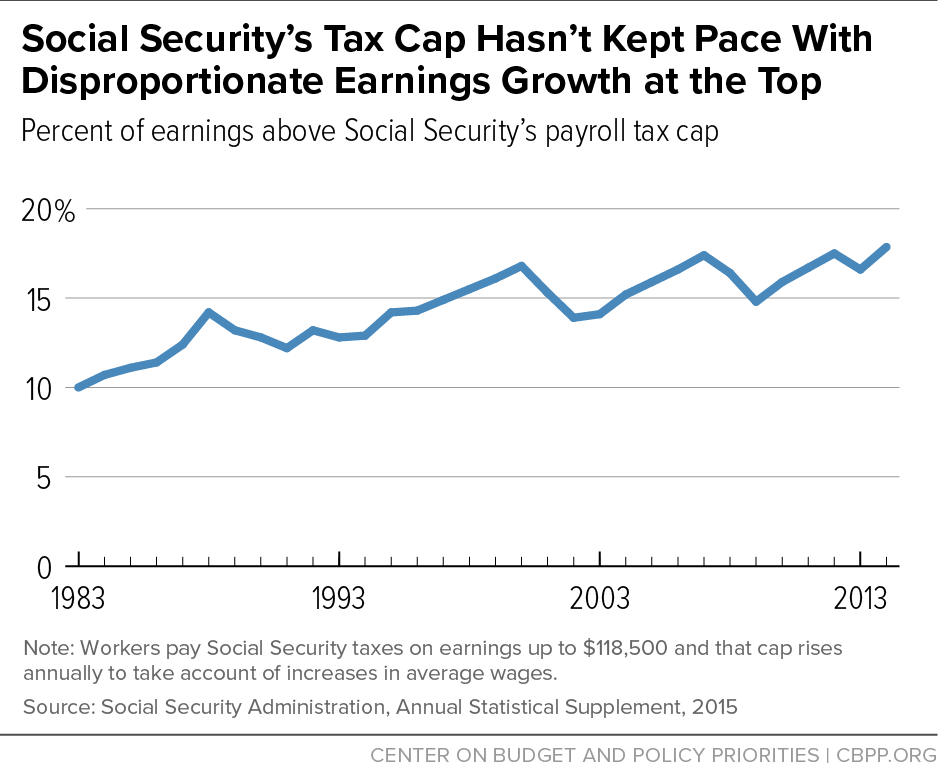

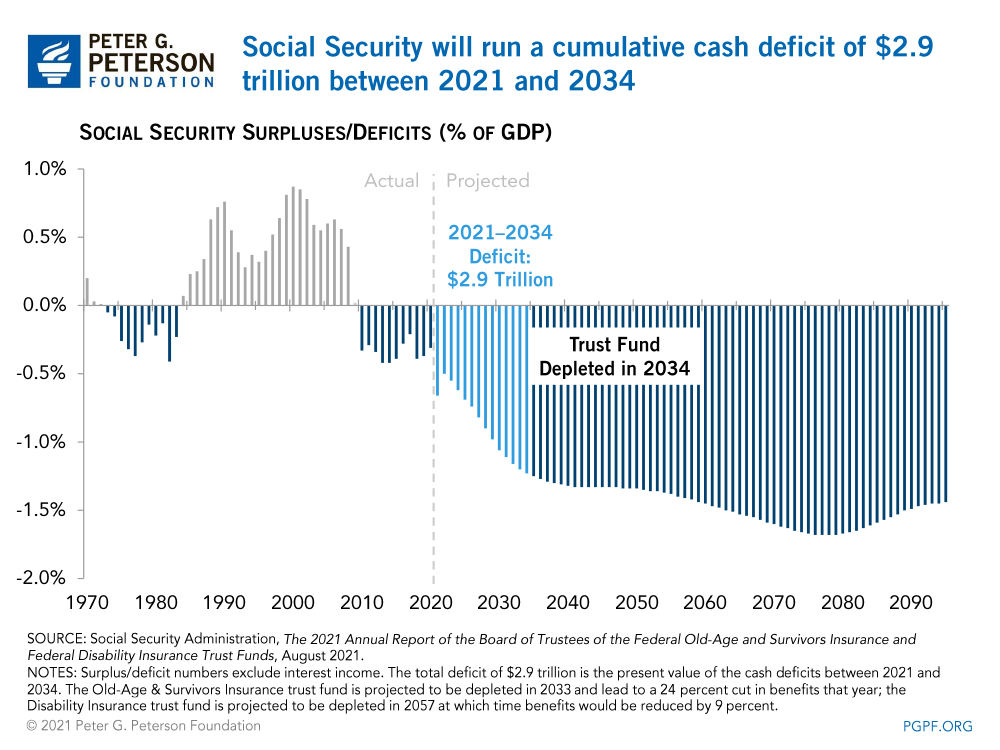

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

2021 Social Security Earnings Limit Youtube Social Security Social Financial Decisions

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Finding Solutions Retirement And Social Security

Pin On Social Security Disability Law

Budget 2022 Provision Of Social Security For Income Tax Assessees Need Of Hour In 2022 Income Tax Social Security Income

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Blockdata Blockchain Crypto In 2021 A Review In Data Blockchain Data Crypto Market Cap